The term health insurance is commonly used in the United States to describe any program that helps pay for medical expenses, whether through privately purchased insurance, social insurance or a non-insurance social welfare program funded by the government. Synonyms for this usage include "health coverage," "health care coverage" and "health benefits."

In a more technical sense, the term is used to describe any form of insurance that provides protection against the costs of medical services. This usage includes private insurance and social insurance programs such as Medicare, but excludes social welfare programs such as Medicaid. In addition to medical expense insurance, it also includes insurance covering disability or long-term nursing or custodial care needs.

The US health care system relies heavily on private and not-for-profit health insurance, which is the primary source of coverage for most Americans. According to the United States Census Bureau, approximately 85% of Americans have health insurance; nearly 60% obtain it through an employer, while about 9% purchase it directly.Various government agencies provide coverage to about 28% of Americans (there is some overlap in these figures).

In 2007, there were nearly 46 million people in the US (over 15% of the population) who were without health insurance for at least part of that year. Over 1 million workers lost their health care coverage in January, February and March 2009. Approximately, 268,400 more workers lost health care coverage in March 2009 than in March 2008. Proving that today, that number is markedly higher as many workers who have lost their jobs have also lost their employer-provided health insurance.The percentage of the non-elderly population who are uninsured has been generally increasing since the year 2000. There is considerable debate in the US on the causes of and possible remedies for this level of uninsurance as well as the impact it has on the overall US health care system.

Before the development of medical expense insurance, patients were expected to pay all other health care costs out of their own pockets, under what is known as the fee-for-service business model. During the middle to late 20th century, traditional disability insurance evolved into modern health insurance programs. Today, most comprehensive private health insurance programs cover the cost of routine, preventive, and emergency health care procedures, and also most prescription drugs, but this was not always the case.

Hospital and medical expense policies were introduced during the first half of the 20th century. During the 1920s, individual hospitals began offering services to individuals on a pre-paid basis, eventually leading to the development of Blue Cross organizations in the 1930s. The first employer-sponsored hospitalization plan was created by teachers in Dallas, Texas in 1929. Because the plan only covered members' expenses at a single hospital, it is also the forerunner of today's health maintenance organizations (HMOs).

Employer-sponsored health insurance plans dramatically expanded as a result of wage controls during World War II .The labor market was tight because of the increased demand for goods and decreased supply of workers during the war. Federally imposed wage and price controls prohibited manufacturers and other employers raising wages high enough to attract sufficient workers. When the War Labor Board declared that fringe benefits, such as sick leave and health insurance, did not count as wages for the purpose of wage controls, employers responded with significantly increased benefits.

Employer-sponsored health insurance was considered taxable income until 1954.

In 1965, President Lyndon B. Johnson signs the Medicare and Medicaid legislation into effect. Since their inception, the greatest challenge to the programs has been “spiraling healthcare costs, stemming largely from innovations in medical technology and pharmaceuticals."] Now, as baby boomers advance toward senior citizenry, concerns about the financial sustainability of the programs frame any discussion about Medicare and Medicaid.

The debate for a public health care system in the United States has gone on for about 70 years. President Harry S. Truman was the first United States president to propose a system of public health insurance in his November 19, 1945 address. This fund would be open to all Americans, but it would remain optional. Participants would pay monthly fees into the plan, which would cover the cost of any and all medical expenses that arose in a time of need. The government would pay for the cost of services rendered by any doctor who chose to join the program. In addition, the insurance plan would give a cash balance to the policy holder to replace wages lost due to illness or injury. This program was denounced as a socialist approach to medicine by the American Medical Association (AMA) and did not pass.

Health care costs have risen more rapidly than the general economic growth and continue to do so, with the consequence that Medicare and Medicaid constitute an increasing economic burden in federal spending.

The United States' system of using health insurance as a means of financing health care costs has been criticized. The following are examples of such criticisms

|

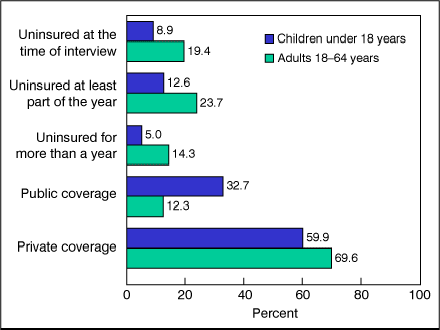

| health insurance, by coverage type and age group: United States |

The US health care system relies heavily on private and not-for-profit health insurance, which is the primary source of coverage for most Americans. According to the United States Census Bureau, approximately 85% of Americans have health insurance; nearly 60% obtain it through an employer, while about 9% purchase it directly.Various government agencies provide coverage to about 28% of Americans (there is some overlap in these figures).

In 2007, there were nearly 46 million people in the US (over 15% of the population) who were without health insurance for at least part of that year. Over 1 million workers lost their health care coverage in January, February and March 2009. Approximately, 268,400 more workers lost health care coverage in March 2009 than in March 2008. Proving that today, that number is markedly higher as many workers who have lost their jobs have also lost their employer-provided health insurance.The percentage of the non-elderly population who are uninsured has been generally increasing since the year 2000. There is considerable debate in the US on the causes of and possible remedies for this level of uninsurance as well as the impact it has on the overall US health care system.

History

Accident insurance was first offered in the United States by the Franklin Health Assurance Company of Massachusetts. This firm, founded in 1850, offered insurance against injuries arising from railroad and steamboat accidents. Sixty organizations were offering accident insurance in the US by 1866, but the industry consolidated rapidly soon thereafter. While there were earlier experiments, the origins of sickness coverage in the US effectively date from 1890. The first employer-sponsored group disability policy was issued in 1911, but this plan's primary purpose was replacing wages lost due to an inability to work, not medical expenses.Before the development of medical expense insurance, patients were expected to pay all other health care costs out of their own pockets, under what is known as the fee-for-service business model. During the middle to late 20th century, traditional disability insurance evolved into modern health insurance programs. Today, most comprehensive private health insurance programs cover the cost of routine, preventive, and emergency health care procedures, and also most prescription drugs, but this was not always the case.

Hospital and medical expense policies were introduced during the first half of the 20th century. During the 1920s, individual hospitals began offering services to individuals on a pre-paid basis, eventually leading to the development of Blue Cross organizations in the 1930s. The first employer-sponsored hospitalization plan was created by teachers in Dallas, Texas in 1929. Because the plan only covered members' expenses at a single hospital, it is also the forerunner of today's health maintenance organizations (HMOs).

Employer-sponsored health insurance plans dramatically expanded as a result of wage controls during World War II .The labor market was tight because of the increased demand for goods and decreased supply of workers during the war. Federally imposed wage and price controls prohibited manufacturers and other employers raising wages high enough to attract sufficient workers. When the War Labor Board declared that fringe benefits, such as sick leave and health insurance, did not count as wages for the purpose of wage controls, employers responded with significantly increased benefits.

Employer-sponsored health insurance was considered taxable income until 1954.

In 1965, President Lyndon B. Johnson signs the Medicare and Medicaid legislation into effect. Since their inception, the greatest challenge to the programs has been “spiraling healthcare costs, stemming largely from innovations in medical technology and pharmaceuticals."] Now, as baby boomers advance toward senior citizenry, concerns about the financial sustainability of the programs frame any discussion about Medicare and Medicaid.

|

| Image of the History HI ;; President Bill Clinton |

Public health care coverage

Public programs provide the primary source of coverage for most seniors and for low-income children and families who meet certain eligibility requirements. The primary public programs are Medicare, a federal social insurance program for seniors (generally persons aged 65 and over) and certain disabled individuals; Medicaid, funded jointly by the federal government and states but administered at the state level, which covers certain very low income children and their families; and SCHIP, also a federal-state partnership that serves certain children and families who do not qualify for Medicaid but who cannot afford private coverage. Other public programs include military health benefits provided through TRICARE and the Veterans Health Administration and benefits provided through the Indian Health Service. Some states have additional programs for low-income individuals.Health care costs have risen more rapidly than the general economic growth and continue to do so, with the consequence that Medicare and Medicaid constitute an increasing economic burden in federal spending.

Health Maintenance Organizations

A health maintenance organization (HMO) is a type of managed care organization (MCO) that provides a form of health care coverage that is fulfilled through hospitals, doctors, and other providers with which the HMO has a contract. The Health Maintenance Organization Act of 1973 required employers with 25 or more employees to offer federally certified HMO options.Unlike traditional indemnity insurance, an HMO covers only care rendered by those doctors and other professionals who have agreed to treat patients in accordance with the HMO's guidelines and restrictions in exchange for a steady stream of customers. Benefits are provided through a network of providers. Providers may be employees of the HMO ("staff model"), employees of a provider group that has contracted with the HMO ("group model"), or members of an independent practice association ("IPA model"). HMOs may also use a combination of these approaches ("network model").Health insurance market concentration

The US health insurance market is highly concentrated, as leading insurers have carried out over 400 mergers from the mid-1990s to the mid-2000s. In 2000, the two largest health insurers (Aetna and UnitedHealth Group) had total membership of 32 million. By 2006 the top two insurers, WellPoint and UnitedHealth, had total membership of 67 million. The two companies together had more than 36% of the national market for commercial health insurance. The AMA has said that it "has long been concerned about the impact of consolidated markets on patient care." A 2007 AMA study found that in 299 of the 313 markets surveyed, one health plan accounted for at least 30% of the combined health maintenance organization (HMO)/preferred provider organization (PPO) market. The US Department of Justice has recognised this percentage of market control as conferring substantial monopsony power in the relations between insurer and physicians.Criticism of Health Insurance in the United States

The United States' system of using health insurance as a means of financing health care costs has been criticized. The following are examples of such criticisms

- While "[p]rivate plans are attractive because of their ability to be responsive to consumer demands for choice and their innovations resulting from both the profit motive and desire to attract a larger enrollment base," they also have disadvantages. Industry consolidation "has not led to strong insurers who are willing or able to negotiate effectively with dominant hospital systems," and "[i]nsurance markets have become dominated by a small number of large insurers" with "shadow pricing" by smaller insurers.

- Insurance companies have high administrative costs. Private health insurers are a significant portion of the U.S. economy directly employing (in 2004) almost 470,000 people at an average salary of $61,409.

- Health insurance companies are not actually providing traditional insurance, which involves the pooling of risk, because the vast majority of purchasers actually do face the harms that they are "insuring" against. Instead, as Edward Beiser and Jacob Appel have separately argued, health insurers are better thought of as low-risk money managers who pocket the interest on what are really long-term healthcare savings accounts.

Posted in:

Posted in: